Jay Z’s 13th solo album, 4.44 was released on June 30 and has generated lots of conversation online. One song on the 10-track album which made waves on social media was The Story of O.J., a laid-back song produced by No I.D. with a Nina Simone sample. Also making the song stand out is a video which tackles Disney’s history of racist representation of black people. If you are yet to hear the song or watch the video you can do so below.

So why is a rap song featured on this finance blog? It’s because in the song Jay Z gives advice about how to not waste money and how to build generational wealth. His main points are for people not to be flashy (Y’all on the ‘Gram holdin’ money to your ear

There’s a disconnect, we don’t call that money over here); to aim for good credit scores; not to waste money on strip clubs or luxury vehicles; and to acquire property especially real estate but also expensive art. Full lyrics here.

Let me classify Jay Z’s points into two broad categories – personal finance and asset speculation.

As far as personal financial advice goes, there is little to disagree with. It is important not to waste money on whatever stuff is keeping you from saving for things you need. It is also important to avoid any poor record of dealing with credit. This will ensure that you will be able to access credit at lower rates. Now, I may personally not hold a stack of money to my ear on Instagram but I don’t think anyone’s finances would be affected if they did. (Unless friends and family will call for their share.)

Now to asset speculation. Jay Z advises drug dealers to buy property in the neighbourhoods in which they live in order to rid it of drugs. Ignoring the fact that this is money laundering and you could attract the law if you are seen acquiring property without an identified source of income, one wonders whether drug dealers would be interested in ending their own business. And then there’s the fact that most of them don’t make much anyway.

But that’s a minor issue, let’s go to the general idea – get credit, buy real estate, buy expensive art and then watch their prices rise and give you wealth you can pass on to your children.

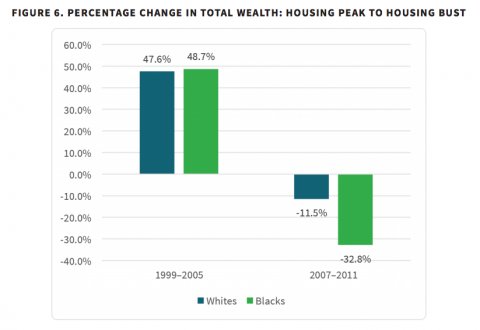

As you can see below, the price of housing in America has risen significantly even through recessions (indicated by the grey areas).  But in 2005 the US mortgage crisis sent house prices reeling and causing great loss to people. Black people especially were affected by this. According to the ACLU, from 2007-2011 black households suffered a loss in total wealth due to the housing crisis that was 3 times larger than the loss suffered by white households. This is shown in the chart below.

But in 2005 the US mortgage crisis sent house prices reeling and causing great loss to people. Black people especially were affected by this. According to the ACLU, from 2007-2011 black households suffered a loss in total wealth due to the housing crisis that was 3 times larger than the loss suffered by white households. This is shown in the chart below.

…when the housing crisis hit, black homeowners had a greater percentage of their wealth tied up in home equity, so a bigger portion of their wealth took a hit.

What makes this worse is that financial institutions deliberately offered worse credit deals to black people compared to white people with the same credit profiles. This article from Reuters states:

The study, which used data from the 100 largest U.S. metropolitan areas, found that living in a predominantly African-American area, and to a lesser extent Hispanic area, were “powerful predictors of foreclosures” in the nation.

Even African-Americans with similar credit profiles and down-payment ratios to white borrowers were more likely to receive subprime loans, according to the study.

So we learn two harsh lessons from real life – being black affects your access to credit and having a large proportion of your wealth in real estate could hurt you. Rather than the problem being that black people were wasting their money in strip clubs rather than buying real estate, it turns out that they had systemic problems accessing credit and despite this they still scraped by to put too much of their money into housing.

When Jay Z talks about fast rising property and art values it is clear that what he is talking about is speculating not investing. When you buy a company’s stock or you start a business, you are depending on an underlying cash flow i.e. the ability of the business to generate money, to drive the value of your investment. When you buy art you are depending on people’s tastes to change in favour of your piece. This is the same with speculative real estate. People buy at higher and higher prices hoping to find someone to sell to at an even higher price. Now this kind of business can be very lucrative, but it can also be devastating to one’s wealth as the US housing crisis proved.

So is this unknown financial blogger claiming to know more than Jay Z, who according to Forbes is worth $870 million? No, actually. A look into the sources of Jay Z’s wealth will reveal that he believes in investing more than speculating. Forbes lists the industries he’s in as music, spirits, clothing, sports and start ups! Jay Z’s notable businesses are all ones which are generating regular cash flow instead of depending on some speculative bubble to drive them up. Never forget that Jay himself is a business, his music sells and his shows sell out. That is a significant part of his cash flow. He does acknowledge this near the end of his last verse (I turned my life into a nice first week release date).

So while I think the song is great and the message is positive, one should be wary of seeing speculation in property as a viable way of building wealth for the average person. Rather, Jay Z’s own dealings should serve as a better blueprint (get it? lol): maximise your regular source of income and invest them into businesses that generate cash flow. When you have a comfortable cushion you can then take a chance on new and less tested businesses (like the start ups Jay’s venture capital fund is investing in) as well as the speculation he mentions in the song.